April 2021

NEWS YOU CAN USE

Insurance tips & Neighborhood news

Northfield Vet and Jen Weston put together a neighborhood Egg Hunt that we were honored to be a part of. Jen and her staff make Central Park a great place with events like this and love taking care of our furry friends!

Support Local and Check them out!

We are proud sponsors of Westerly Creek Elementary School and will be volunteering at the annual Spring Clean up on April 24th.

Thank you to the Allstate Foundation for helping us earn and extra

$500 for the school for this event!

How Much Homeowners Insurance Do I Need?

Many people ask – “how much insurance do I need for my home?” If you have a mortgage, your lender may require a minimum amount of dwelling and liability coverage. If you don’t have a mortgage, you don’t have to buy homeowners insurance. Of course, while coverage is technically optional, it would be very risky to leave what’s probably your largest asset unprotected. Instead, a good rule of thumb is to have enough homeowner’s insurance to:

- Rebuild your home

- Replace your belongings

- Cover injuries and damages that happen on your property

- Reimburse your living expenses while you can’t live in your home

Standard homeowners insurance policies have four types of coverage that help you reach these goals: dwelling coverage, personal property coverage, liability coverage, and additional living expenses coverage.

Dwelling Coverage

Dwelling coverage is the part of your homeowners insurance policy that helps pay to rebuild or repair your home and any attached structures—such as a garage, deck, or front porch—if they’re damaged by a covered peril. Your dwelling coverage should equal your home’s replacement cost. This should be based on rebuilding costs, not your home’s price. The cost of rebuilding could be higher or lower than its price depending on location, the condition of your home, and other factors.

Personal Property Coverage

Personal property coverage applies to everything in your home besides the house itself—appliances, clothes, furniture, electronics, sports equipment, toys, and even the food in your fridge. The coverage kicks in if your belongings are destroyed, stolen, or vandalized. In general, you should have enough coverage to replace all your belongings. This amount can be difficult to estimate, as most people have no idea how much stuff they have. A good idea is to make an inventory of everything you own: write down a detailed list of what’s in each room and take photos. (If you have expensive or rare items—including jewelry, musical instruments, high-end sports equipment, or valuable art—you may need

additional coverage.)

Liability Coverage

Liability coverage is the part of your homeowners policy that kicks in if someone is hurt on your property. (Examples include – Dog bites, home accidents, falling trees, injured workers, etc.) Most homeowners insurance policies have at least $100,000 in liability coverage. You can increase that up to at least $300,000 or more. If you need liability coverage that goes beyond your homeowners insurance policy, you can buy an umbrella insurance policy.

Additional Living Expenses Coverage

Additional living expenses coverage is the part of your homeowners insurance that acts like an emergency fund if you’re temporarily displaced from your home. It covers things such as staying in a hotel or the added costs of eating at restaurants when you can’t cook at home. This is usually calculated as a percentage of your dwelling coverage.

Join us in April for the Walk to Hope. We are committing to walk 10,000 steps a day for a total of 25 miles at the end of the month. Click on the lind below to sign up and learn more about BHGH. Don’t forget to join our team: Allstate The Mathes Agency— Team Helping Hands

Click on the image to access the event web page

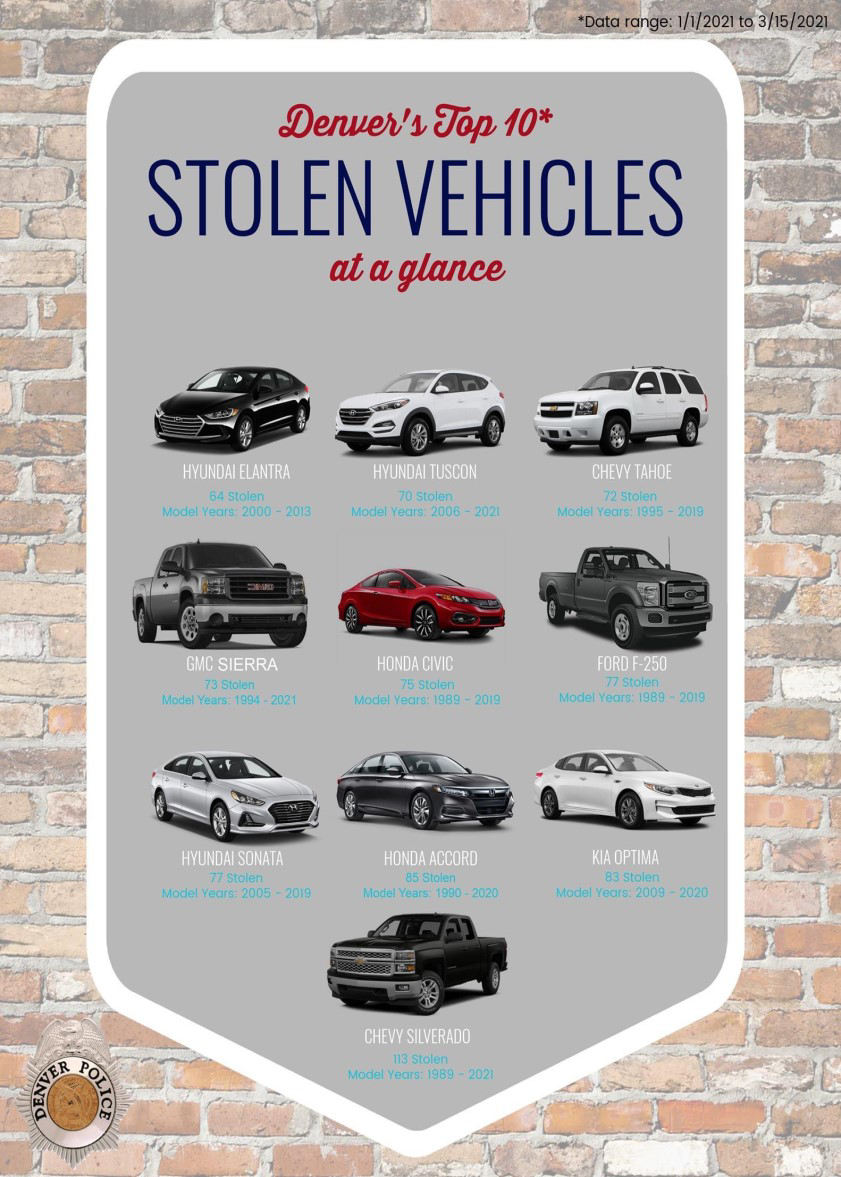

Car Thefts are up in 2021

!!! Make sure that you have the right coverage !!!